Deloitte Corporate Finance Denmark

In Deloitte Corporate Finance, we provide M&A advisory to company owners, entrepreneurs and private equity clients. In close dialogue with our client, we handle every strategic, financial and tactical aspect of the process when either buying or selling a company.

We handle all the intensive workloads from the initial considerations to a successful sale

- Early Considerations

Reflections of a sale often arise from a shift in generations of the founding family or with the purpose of finding a partner to support future growth through experience and financial resources. An early dialogue helps to clarify motives and expectations for a potential sale. We assess the best possible exit strategy and design a customised process based on our client’s preferences.

- Internal Preparations

Preparing a company for a potential sale includes a discussion and review of business plan, growth opportunities and potential areas of improvement. This in close dialogue with both seller and management team. A thorough financial and commercial analysis can further strengthen the company in a transaction and is carried out in close collaboration with other advisers.

- Identification of Investors

The number of investors entering into dialogue within a sales process is based on a range of important considerations. We identify all relevant investors, both globally and locally, based on strategic fit, corporate culture, the ability to finance the investment, etc. Together, we decide on the appropriate strategy for a successful sale.

- Preparation of Sales Materials

The sales material is the first impression potential investors have of the company, which is why quality is essential. The material is prepared by us in close collaboration with the management team and highlights the key selling points of the company. Potential investors are provided sufficient information to submit indicative offers while ensuring that sensitive information is not exposed.

- Market

ContactWe handle all investor dialogues from the initial contact to the final negotiations. Essentially, it is important for the seller to connect with the relevant counterparties to discuss the future of the company. We prepare both seller and management team on relevant topics and make sure that they are well prepared for the dialogue.

- Negotiation and Final Agreement

We evaluate individual offers in close dialogue with our client and negotiate on their behalf. A successful sale is obtained when finding the best possible partner for the future journey of the company while securing an attractive price and favourable terms for the seller.

Reflections of a sale often arise from a shift in generations of the founding family or with the purpose of finding a partner to support future growth through experience and financial resources. An early dialogue helps to clarify motives and expectations for a potential sale. We assess the best possible exit strategy and design a customised process based on our client’s preferences.

Our team of dedicated M&A professionals advises on the strategic important decision when a client is looking to acquire a minority or majority stake in a company.

We have extensive experience from both sell and buy-side advisory, which enables us to provide the best possible bid and response tactics throughout the bidding process and final negotiations. Based on our distinctive sector knowledge we thoroughly analyse and value the acquisition target and potential synergies. This approach also supports an early identification and resolution of potential issues.

Strategic acquisitions can take a company to new heights by improving, extending or transforming the current business. We assist our clients in developing, prioritising and executing a solid M&A strategy. Our global reach and insight is valuable in identifying and initiating the dialogue with attractive acquisition targets.

Our business model is based on trust and has resulted in long-term client relationships.

Transactions

Tap on the tiles to read more

Advised Kimbrer Computer in the partnership agreement with Trill Impact

Advised The Army Painter in the partnership agreement with CataCap

Advised SAS Cargo Group in the divestment of Trust Forwarding to Scan Global Logistics

Advised Sedgwick Leif Hansen in the full ownership sale to Sedgwick

Advised CataCap and the minority owners on the divestment of Lyngsoe Systems to Accent Equity

Advised CareCom in the merger with Lyniate

Advised BASE Life Science in the sale to Infosys

Advised AnaCap Financial Partners on the acquisition of EDIGard from Nets Group

Advised INFRANODE on investment in Tafjord Connect (49% stake)

Advised Axcel and the minority owners on the sale of European Sperm Bank to Perwyn

Advised the three Danish biogas plants (Vesthimmerland, Grønhøj and Igslsø) in the sale to BioCirc

Advised Cookie Information in the sale of a minority stake to Kirk Kapital

Advised Birch Ejendomme in the majority sale to Aermont Capital

Advised INGENIØR'NE in the majority sale to Storskogen

Advised DAFA Group in the sale to CataCap

Advised INFRANODE and DIF Capital Partners in raising new long-term debt for the refinancing of Velfra

Advised DANX Group in the sale to Axcel

Advised Vinkel Bioenergi in partnering with BioCirc

Advised EWII in the sale of 24 MW onshore wind in Sweden to Rabbalshede Kraft

Advised EWII in the sale of 26 MW onshore wind in Germany to ENOVA Group

Advised Karnov Group in the acquisition of carved out businesses of Thomson Reuters and Wolters Kluwer

Advised Roblon in the acquisition of VAMAFIL

Advised Inflexion in the refinancing of Infront

Advised Bridgepoint Development Capital in the raising of financing for the acquisition of LanguageWire

Assisted the administrator in the sale of Hydratech Industries to Dellner Group

Advised Stirling Square Capital Partners and TA Associates in the finance raise supporting the listing of Byggfakta Group

Advised JS World Media in the sale to Solix

Advised SellmerDiers Sperm Bank in the sale to Medicover

Advised Solix and Carsoe in the divestment of Carsoe Liquid Tanks to Beritech Group

Advised VKR Holding owned DOVISTA in the acquisition of WERU

Advised Nutrimin in the sale to Nutreco

Advised Altor Equity Partners in the acquisition of Multi-Wing Group

Advised LendMe in the sale to Axo Finans

Advised Kirk Kapital in the sale of a majority stake in Globeteam to Norvestor

Advised Alm. Brand in the acquisition of Codan Forsikring

Advised Claus Sørensen foundation in the sale of Claus Sørensen to Lineage Logistics

Advised FairWind in the sale to Triton Partners

Advised YOYO Global Freight in the sale to Link Logistics

Advised EWII in the acquisition of El-Net Øst

Advised Lars Larsen Group and JYSK in the acquisition of SOFACOMPANY

Advised Hg backed IT RELATION in the acquisition of Itadel and Cloud Teams from Maj Invest Equity

Advised Triton Partners in the acquisition of Geia Food

Advised Luxion in the sale of a large minority stake to GRO Capital

Advised Wind Estate in the sale to Icon Infrastructure

Advised Vilhelm Lauritzen Architects in the sale to Findos Investor

Advised Obsidian Digital in the sale to Capidea

Advised USTC in the acquisition of CM Biomass Partners

Advised Hg in the acquisition of Trackunit

Advised eGISS in the sale to EMK Capital

Advised BlackFin Capital Partners in the establishment of a strategic joint venture partnership with Fokus Asset Management

Advised IT RELATION in the acquisition of Sweden based Emineo

Advised the sale of 15,7 MWp solar PV assets in Spain to Sonnedix

Advised ProfilService in the sale to Den Sociale Kapitalfond

Advised BeGreen in the sale of Denmark's largest solar PV portfolio to Luxcara

Advised Encode in the sale to Viking Venture

Advised AURA Energi in the 50% acquisition of Demark's largest onshore wind farm from Eurowind Energy

Advised VKR Holding owned DOVISTA in the acquisition of Arbonia

Advised Blue World Technologies on raising growth financing

Advised Vestjysk Bank in the proposed merger with Den Jyske Sparekasse

Advised Axcel in the refinancing of their portfolio company, Loopia Group

Advised GRO Capital and the founder of Boyum IT Solutions in the sale of a majority stake to Volpi Capital

Advised Junget in the sale to Blue Equity

Advised DAN-FORM Denmark in the sale to RÖKO

Advised on the sale of 19 Danish onshore wind parks to Momentum Gruppen

Advised ProActive in the merger with Fellowmind

Advised Timedico (Tempus600) in the sale to SARSTEDT Group

Advised Solix and Hoyer Group in the divestment of Hoyer Transmissions to Jens S. Transmissioner A/S (part of Axel Johnson International)

Advised MT Højgaard in the divestment of Lindpro to Kemp & Lauritzen

Advised PureGym in the acquisition of Fitness World

Advised Kirk Kapital in the acquisition of a minority stake of TITAN Containers

Advised LIP Bygningsartikler in the sale to Bostik/Arkema

Advised Hedeselskabet in the sale to WSP

Advised EQT Partners in the acquisition of Ellab

Advised the owner of Massive Catering in the sale to Løgismose Meyers

Advised Miracle in the divestment of its hosting and database related services to IT Relation

Advised Danske Spil in the divestment of CEGO to management and VIA Equity

Advised Axcel in the acquisition of Phase One

Advised Saint Gobain Denmark in the divestment of Optimera Denmark

Advised AnaCap Financial Partners in the acquisition of Dansk Sundhedssikring

Advised the owners of European Sperm Bank in the sale to Axcel

Advised Axcel in the sale of Ball Group (Zizzi) to Findos Investor

Advised Danske Spil in the acquisition of the activities relating to TivoliCasino.dk

Advised GlobalConnect/Broadnet in the acquisition of Netteam

Advised the Dyøe family in the majority sale of STENHØJ GROUP to Nexion S.p.A.

Advised the owner of Mobilhouse in the sale to Adelis Equity Patners

Advised Kemp & Lauritzen in the divestment of Venair to Bravida

Advised Ørsted in the divestment of Stigsnæs Power Station and Stigsnæs Transit Harbour

Advised the owner of Hotel Ritz in the sale to Milling Hotels

Advised Rosendahl in the acquisition of Kähler

Advised the shareholders of Rekom Group in the sale to Catacap

Advised Stjernegaard Rejser in the sale to Aller Leisure A/S

Advised the Nielsen family in the sale of DKI Plast s.r.o. to KB Components

Advised Roblon A/S in the acquisition of production assets for the supply of parts to the wind turbine industry

Advised Viking Life Saving Equipment in the acquisition of Norsafe

Advised the founders of Gorm's in the sale to Orkla ASA

Advised P. Hermansen in the sale to Bravida

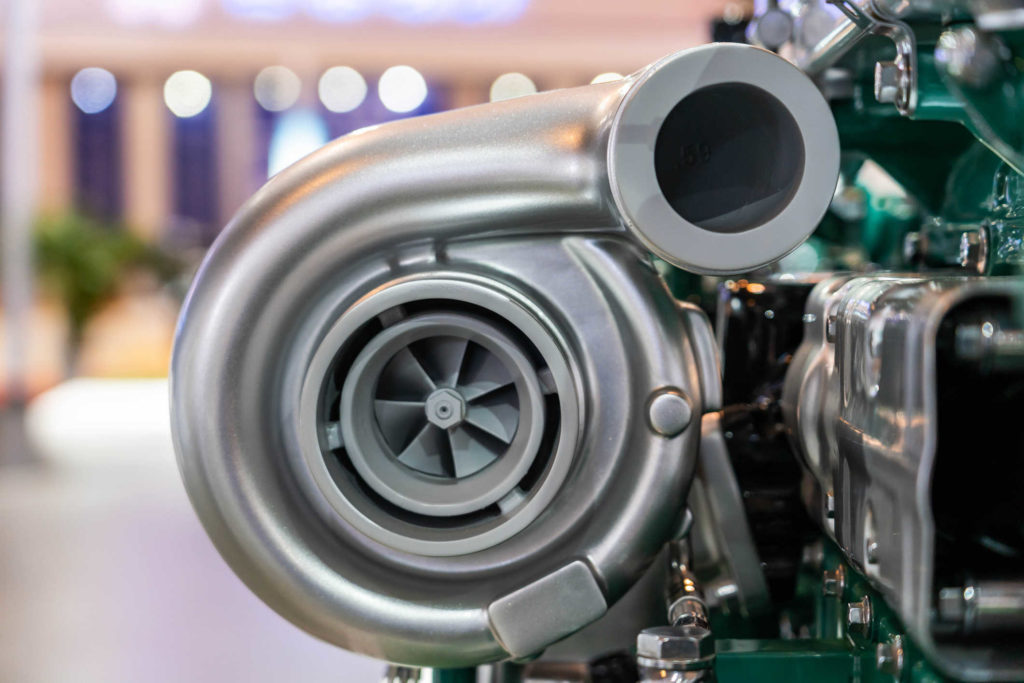

Advised Dinex in the partnership agreement with 3C Groups

Advised the shareholders of Hotel City in the sale to Secure Fondsmæglerselskab

Advised Roblon A/S in the carve-out and concurrent sale of the majority of Roblon Engineering to Erhvervsinvest

Advised Søgemedier in the sale to Adelis Equity Partners

Advised Elite Miljø in the sale to Coor

Advised Geia Food in the sale to Credo Partners

Fairness Opinion to Forenet Kredit in the sale of a minority stake to a consortium led by PFA

Advised FSN Capital in the acquisition of Fitness World

Advised EQT and GlobalConnect in the acquisition of Nianet

Advised GlobalConnect in the sale to EQT Infrastructure

Advised Oase Outdoors in the sale to Ratos

Advised ferm LIVING in the sale to Vendis Capital

Advised Sondex in the sale to Danfoss

Advised Icotera in the sale to Maj Invest

Advised Maj Invest in the divestment of JKF Industri to Groupe SFPI

Advised Nygart in the sale to Polaris’ portfolio company Akademikliniken

Advised V2 Tobacco in the sale to Swedish Match

Advised TREFOR in the divestment of dominus to Adelis Equity Partners’ portfolio company Nordomatic

Advised Nordtronic in the sale to SLV

Advised Arepa in the sale to Envista Forensics

Advised FSN Capital in the acquisition of Netcompany

Advised NKT Cables APAC in the sale to Srising Technology

Advised EWII in the acquisition of Digizuite

Advised Jørgen Kruuse in the sale to Henry Schein

Advised GPV International in the sale to Schouw & Co

Advised Covidence in the sale to Montagu Private Equity

Advised FSN Capital in the acquisition of EET Europarts

Advised Stauning Whiskey in the sale of shares to Diageo

Advised Montagu Private Equity in the acquisition of DEAS

Advised Agilitas in the acquisition of Norrecco & City Container

Advised Pitzner Materiel in the sale to CataCap

Advised LauRie in the sale to Industri Udvikling

Advised Cabinplant in the sale to CTB (subsidiary of Berkshire Hathaway)

Advised Solar Group in the divestment of Solar Deutschland to Sonepar

Advised Pagunette in the sale to Leaf Holding

Advised Tican in the sale to Toennies Lebensmittel

Advised Shipping.dk in the acquisition of Maersk Broker Agency

Advised USATours.dk in the sale to TemaTours

Advised Berkshire Boyter Holding in the acquisition of WindowMaster from VKR Holding

Advised Prime Cargo in the sale to Mitsui-Soko Group

Advised Østjydsk Bank in the sale of branches in Randers and Gjerlev to Jutlander Bank

Advised Nordjyske bank in the rights issue & the public takeover of Nørresundby Bank

Advised Bazoom in the sale to NORDJYSKE Medier

Advised Itplaneten in the sale to C2IT

Advised Ciconia in the sale to Privathospitalet Mølholm

Advised Kartoffel-Kompagniet in the sale to Wernsing Feinkost

Advised NGI in the sale to Adelis Equity Partners

Advised Danske Spil in the acquisition of CEGO

Advised Lyngsoe Systems in the sale to Catacap

Advised TryghedsGruppen in the sale of Previa to Falck

Advised TryghedsGruppen in the sale of Quick Care to Falck

Advised Århus Charter in the sale to Primo Tours

Advised Masco in the divestment of Tvilum to Revolution

Advised DiBa Bank in the public takeover by Sydbank

Advised Nyhavn Rejser in the sale to Aller Media

Advised ABC Mokka in the sale to Miko Coffee

Advised TryghedsGruppen in the sale of Sahva to the management of Sahva

Advised Team Online in the sale to EG

Advised Sport-Master in the sale to Nordic Capital

Advised Axcel in the sale of IDdesign to Jysk

Advised ISS Document in the sale to Post Danmark

Advised Welltec on the private placement of shares to PFA Pension

Advised Tide in the acquisition of Rutebilselskabet Haderslev

Advised Solar Group in the divestment of Aurora Group to Deltaco

Advised SE Blue Equity in the acquisition of EMT Nordic

Advised Den Sydvestjydske Venstrepresse in the acquisition of Syddanske Medier from Berlingske Media

Advised the independent store owners in the sale to Matas A/S

Advised Højbjerg Maskinfabrik in the evaluation of strategic opportunities and debt refinancing

Career

Deloitte Corporate Finance is the leading Danish M&A adviser and we have an increasing high level of activity. As employee, whether straight out of school or experienced, this forms the best possible foundation of obtaining M&A experience from day one.

We offer a unique career opportunity with highly competent colleagues, a steep learning curve and the opportunity of taking your career from learning to leadership. Expect international exposure through interaction with colleagues, clients and potential investors across the world.

Having fun at work is an important part of our culture, as we believe it fosters stronger team spirit and happy employees. Our working environment is characterised by a high degree of involvement and interaction across all levels of seniority on every project.

We continue to expand our footprint in the Nordic M&A market, which is why we are always looking for ambitious and talented individuals with a strong drive to join our team.

Stay tuned for open position: Here

Contact